Have you ever tried to get a small business loan of, say, R20,000 to R100,000?

If you have, you probably know the frustration. You might run a great business—like an online piano school, a coffee shop, or a web design agency—with steady income and happy customers. But when you approach a traditional bank for a small loan to buy equipment or run a marketing campaign, you’re met with impossible demands:

-

“We need three years of audited financial statements.”

-

“Where is your collateral? Can you put up your house?”

-

“Your application will take 6-8 weeks to process.”

For a small, fast-moving business, this is a dead end. This all-too-common experience has a name: The Micro-Business Funding Gap.

Stop guessing. Start building.

We've built a free Business Idea Generator Tool that walks you through this exact framework and generates a professional Validation Report.

Access the Free ToolIt’s the single biggest barrier to growth for small businesses in South Africa, but a new wave of technology is finally starting to build a bridge.

What is the Micro-Business Funding Gap?

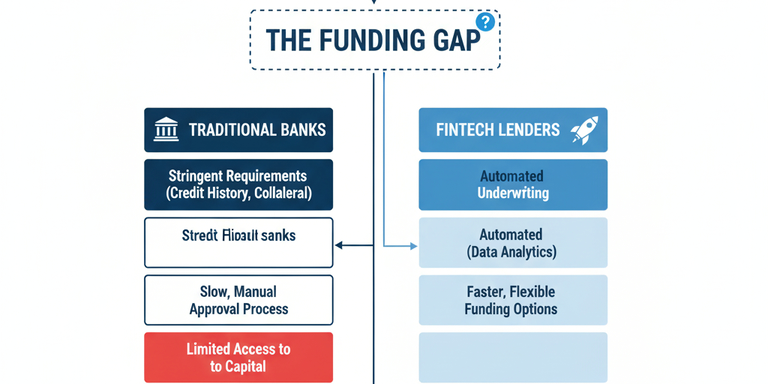

In short, the “funding gap” is the massive disconnect between the demand for small, short-term loans and the supply from traditional lenders.

Recent data from reports like the 2025 SA MSME Access to Finance Report paints a clear picture:

-

Massive Demand: The overwhelming majority of funding applications (over 85%) come from micro-enterprises (those with a turnover of less than R1 million a year).

-

Small Loan Sizes: Most of these businesses aren’t asking for millions. Over a third (38.7%) are looking for loans under R250,000 to buy stock, cover working capital, or purchase equipment.

-

Low Supply: These are the very businesses that create the most jobs (over 80% of them!), yet they are the least likely to get funding from traditional banks.

This creates a “missing middle” where businesses are too big for micro-grants but considered “too small,” “too new,” or “too risky” for traditional bank loans.

Why Do Traditional Banks Reject Small Businesses?

This isn’t just because banks are “old-fashioned.” Their entire system is built in a way that makes it difficult to serve micro-businesses:

Free Tools Mentioned

Access our interactive calculators to simulate your specific business numbers.

Unlock All Tools Free-

It’s Too Expensive for Them: It costs a bank almost the same amount in paperwork, risk analysis, and staff time to underwrite a R50,000 loan as it does to underwrite a R5,000,000 loan. For them, the small profit on a micro-loan simply isn’t worth the administrative cost.

-

They Rely on “Collateral”: The traditional risk model is based on security. If you default, they take your house or car. Modern businesses, like an online piano school or a digital marketing agency, don’t have this kind of physical collateral. Their assets are digital.

-

They use “Outdated” Risk Models: Banks look at your personal credit history and your years in business. They struggle to assess a new, “asset-light” business that has a thin credit file but very healthy real-time cash flow.

As a result, viable, profitable micro-businesses are starved of the capital they need to grow.

How Technology is Finally Solving the Problem

This is where the good news begins. The funding gap isn’t being filled by the old banks; it’s being bridged by new technology and new lenders.

Here’s how:

-

New Players: Fintech and alternative lenders have entered the market specifically to target this “missing middle.” Their entire business model is built on technology, not on walk-in branches.

-

New Scoring Models: Instead of just a credit report, these new lenders use AI-driven and alternative credit scoring. They securely (and with your permission) analyse your real business data, such as:

-

Your daily sales from Yoco, PayFast, or your e-commerce store.

-

Your real-time cash flow from your business bank account.

-

Your invoicing history from Xero or Sage.

-

-

New Products: This new analysis allows for flexible loan products that match how a small business actually works, like Merchant Cash Advances (repaid as a percentage of your sales) or a revolving Line of Credit.

This tech-driven approach makes it profitable for a lender to provide a R50,000 loan. They can analyse your risk in minutes, not weeks, and disburse funds in 24-48 hours.

How to Bridge the Gap: Get Your Business “Funding Ready”

If you’re a micro-business owner, you can no longer prepare to apply for a loan the “old way.” You need to prepare for the “new way.”

This is all part of becoming “Funding Ready” for the modern lender.

-

Digitise Your Income: Cash is invisible. To a fintech lender, digital revenue is proof. Use a POS system like Yoco or a payment gateway like PayFast for all your sales. This creates a powerful, verifiable data trail of your income.

-

Open a Separate Business Bank Account: This is the #1 rule. Stop running your business from your personal account. A clean, dedicated business account that shows all your income and expenses is the most powerful tool you have.

-

Use Digital Invoicing: Stop using Word or Excel. Use an accounting program (even a free one) to send invoices. This creates a track record of your revenue and shows lenders who your customers are and how quickly they pay.

-

Explore Alternative Lenders: Stop starting with the bank that has your mortgage. Start by looking at the lenders who are built for you.

You Are Not Alone

If you’ve been frustrated by the lack of funding for your small business, understand that it’s not you—it’s the system. The traditional model was not built for you.

But the landscape is changing fast. For the first time, the businesses that form the backbone of South Africa’s economy have options. By understanding why the gap exists and embracing the digital tools that

Need Startup Capital?

If your business is already trading, check your eligibility for up to R5M in unsecured funding.

Check Eligibility