Understanding Good Credit History for Business Loans

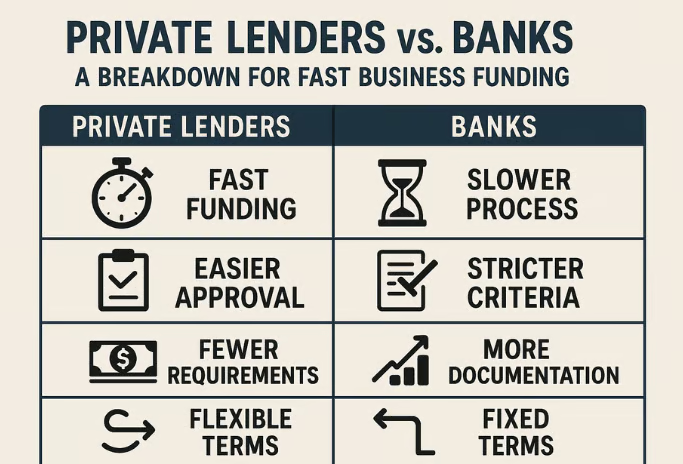

When a South African SME applies for a business loan, the phrase “good credit history” is a common requirement. It might seem vague, but it’s a critical component of the lender’s decision-making process. Think of your credit history as your financial reputation—it tells a story about your past behaviour as a borrower. Lenders use this […]

Understanding Good Credit History for Business Loans Read More »